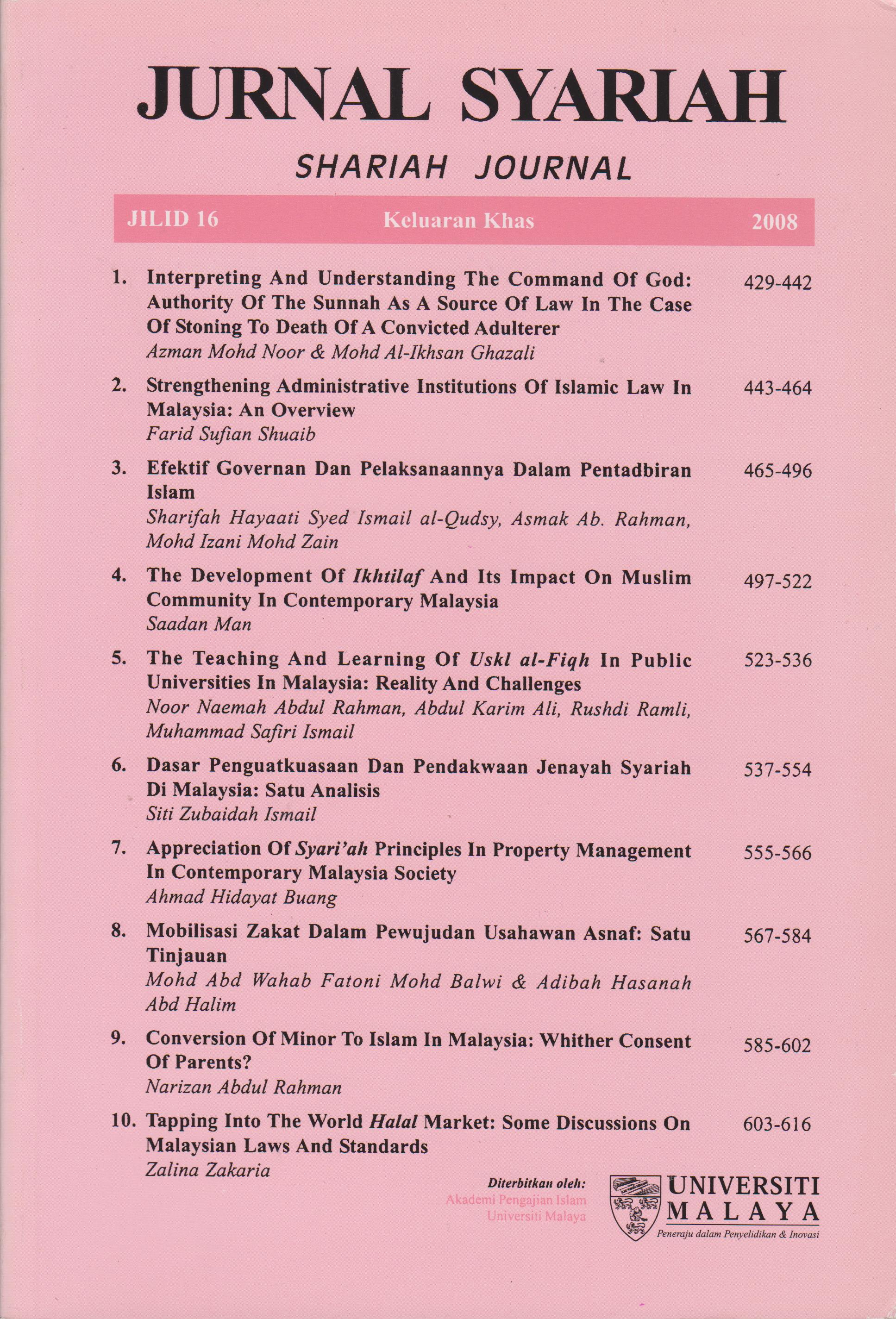

MALAYSIAN SUKUK: ISSUES IN ACCOUNTING STANDARD

Keywords:

Islamic Bonds, Sukuk, Islamic Law, Islamic Banking, Islamic Financial Market, Accounting, Reporting StandardsAbstract

There is a high demand and need for developing alternatives to

the traditional debt market, which are acceptable to Islamic law

as bonds play a major role in the economy in raising capital. The

main objective of this paper is to examine the contemporary

accounting regulatory issues on investment in Islamic bonds or

Sukuk in Malaysia. Sukuk can be based on various Islamic

contracts, namely Mudarabah, Murabahah, Musharakah, and

Ijarah. Due to the growth in the Islamic financial market, namely

the Islamic bonds, as well as the growing interest in Islamic banking

and insurance, the need for specific accounting requirements that

can accommodate these contracts is imperative. This paper is based

on the rationale that for the Islamic financial market to prosper, it

requires well regulated Islamic financial instruments, as well as

appropriate accounting standards and guidelines in recording

these instruments. Therefore, a well regulated Islamic financial

market requires sound accounting and reporting standards for

Islamic financial instruments that meet the requirements of Shari‘ah

as well as being practical. In addition, this paper also highlights

issues raised concerning the accounting practices in Islamic bonds

investments.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

COPYRIGHT: All rights reserved. Not allowed to be reproduced any part of articles and contents of this journal in any form or by any way, whether electronic, mechanical, photocopying, recording or otherwise without permission in writing from the Chief Editor, Jurnal Syariah.